Unpaid invoices can pose significant challenges for retail staffing agencies, impacting cash flow, relationships, and legal standing. Managing these unpaid invoices requires clear payment terms, effective collections processes, and the use of invoice factoring services. The impact on retail staffing agencies includes financial instability, operational disruptions, and potential damage to their reputation. In conclusion, addressing the issue, seeking legal recourse, and mitigating future risks are crucial steps for retail staffing agencies facing unpaid invoices.

Key Takeaways

- Establish clear and concise payment terms to avoid ambiguity and disputes.

- Implement effective collections processes to recover unpaid invoices in a timely manner.

- Utilize invoice factoring services to improve cash flow and mitigate the impact of unpaid invoices.

- Address unpaid invoices promptly to prevent financial instability and operational disruptions.

- Seek legal recourse when necessary to enforce payment and protect the agency’s interests.

Challenges of Unpaid Invoices

Impact on Cash Flow

Unpaid invoices can have a significant impact on a company’s cash flow. Without timely payment, it becomes challenging to meet financial obligations, leading to potential cash flow shortages. This can result in delayed payments to suppliers and increased reliance on credit, further exacerbating the situation. See the table below for a breakdown of the impact on cash flow:

| Impact | Description |

|---|---|

| Reduced Cash Flow | Decreased liquidity and financial strain |

| Increased Credit Dependency | Higher reliance on credit to cover expenses |

Retail staffing agencies must address these challenges to maintain financial stability and ensure smooth operations.

Legal Ramifications

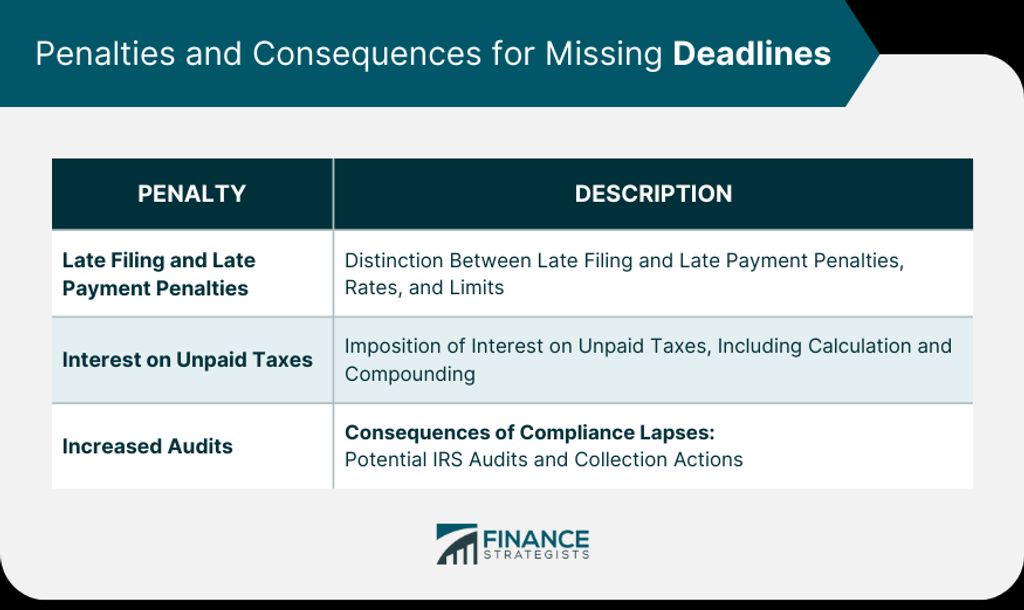

Unpaid invoices can lead to legal action and court proceedings. Retail staffing agencies must be aware of the potential consequences of non-payment, including fines, penalties, and damage to their reputation. It’s crucial to consult legal counsel and understand the contractual obligations to avoid legal disputes.

Strained Relationships

Strained Relationships

Unpaid invoices can lead to strained relationships between retail staffing agencies and clients. This can result in communication breakdowns, trust issues, and a lack of future collaboration. It’s important to address these challenges proactively to maintain healthy business partnerships.

| Impact | Description |

|---|---|

| Financial | Delays in payments affect cash flow |

| Operational | Disruptions in staffing operations |

| Reputation | Damage to the agency’s reputation |

- Establish clear communication channels

- Foster transparency in billing processes

- Seek mutual understanding and resolution

Building and maintaining strong client relationships is crucial for the success of retail staffing agencies.

Managing Unpaid Invoices

Establishing Clear Payment Terms

Establishing clear payment terms is crucial for ensuring timely payments from clients. By clearly outlining the terms of payment, including due dates and acceptable payment methods, retail staffing agencies can minimize misunderstandings and delays. Additionally, providing a detailed breakdown of fees and charges in a transparent manner can help build trust and foster positive relationships with clients. It is also important to establish a streamlined process for addressing payment discrepancies and to regularly communicate with clients regarding their outstanding balances.

| Key Considerations |

|---|

| – Clear due dates |

| – Acceptable payment methods |

| – Transparent fee breakdown |

Effective communication and transparency are essential for maintaining healthy client relationships and preventing payment disputes.

Retail staffing agencies must prioritize the establishment of clear payment terms to ensure smooth financial transactions and mitigate the risk of overdue payments. By implementing these measures, agencies can maintain financial stability and foster trust with their clients.

Implementing Effective Collections Processes

In order to effectively manage unpaid invoices, retail staffing agencies must establish clear payment terms to ensure clarity and transparency. Implementing effective collections processes involves a strategic approach, including daily phone calls, demand letters, skip tracing, settlement negotiations, and dispute resolution. A well-structured collections process can help agencies recover outstanding balances and prevent accounts from becoming write-offs. It’s crucial to have 24/7 online account access for fast remittances and electronic payments.

| Collections Process | Description |

|---|---|

| Phase 1 | Daily phone calls, demand letters |

| Phase 2 | Skip tracing, settlement negotiations, dispute resolution |

Expect our collector to place daily phone calls for the first 14 to 21 days in an attempt to contact the debtor. If all attempts to reach a conclusion to the account fail, we go to Phase Two, where we immediately forward.

Utilizing Invoice Factoring Services

When facing challenges in cash flow due to unpaid invoices, invoice factoring services can provide a viable solution. By selling outstanding invoices to a third-party company, businesses can access immediate funds to maintain operations. This process allows for a more predictable cash flow and reduces the impact of delayed payments on day-to-day operations. Additionally, the use of invoice factoring services can alleviate the burden of managing collections, allowing businesses to focus on core operations.

Impact on Retail Staffing Agencies

Financial Instability

Financial instability is a major concern for retail staffing agencies facing unpaid invoices. This can lead to cash flow problems and hinder day-to-day operations. It’s important for agencies to prioritize establishing clear payment terms and implementing effective collections processes to mitigate the impact of unpaid invoices. Additionally, seeking legal recourse may be necessary to address persistent non-payment.

Operational Disruptions

Operational disruptions due to unpaid invoices can lead to significant challenges for retail staffing agencies. These disruptions can result in delayed payroll, reduced employee morale, and increased turnover rates. Effective collections processes and clear communication with clients are crucial in mitigating these disruptions. Retail staffing agencies may also consider partnering with a B2B debt collection agency to streamline the recovery of unpaid invoices.

| Challenges | Solutions |

|---|---|

| Delayed payroll | Establish clear payment terms |

| Reduced employee morale | Implement effective collections processes |

| Increased turnover rates | Utilize invoice factoring services |

Retail staffing agencies must proactively address operational disruptions caused by unpaid invoices to maintain business continuity and client relationships.

Conclusion

Addressing the Issue

Addressing the Issue

Retail staffing agencies must proactively address unpaid invoices to maintain financial stability and operational efficiency. Implementing clear communication channels with clients, seeking legal recourse when necessary, and mitigating future risks through effective collections processes are essential steps to safeguarding the agency’s financial health. Remember, a proactive approach is key to minimizing the impact of unpaid invoices.

Seeking Legal Recourse

After exhausting all internal collection efforts, seeking legal recourse may be necessary to recover unpaid invoices. This involves filing a lawsuit against the debtor to obtain a judgment. However, the complexities of post-judgment enforcement are paramount to successfully collecting the obligation. Utilizing a skilled third-party collection partner with network attorneys can provide the expertise needed for post-judgment enforcement. Accounts Receivable Management is crucial in preventing distressed accounts from becoming write-offs. Additionally, maintaining a watchful eye over outstanding accounts and utilizing effective third-party collection partners can mitigate future risks.

| Key Services | Features |

|---|---|

| Daily Phone Calls | Phase 1 Collection Efforts |

| Demand Letters | Formal Communication with Debtor |

| Skip Tracing | Locating Debtor’s Contact Information |

| Settlement Negotiations | Resolving Outstanding Debts |

| Dispute Resolution | Handling Disputes Effectively |

Expect our collector to place daily phone calls for the first 14 to 21 days in an attempt to contact the debtor. If all attempts to reach a conclusion to the account fail, we go to Phase Two, where we immediately forward

Mitigating Future Risks

After addressing the issue of unpaid invoices, it’s crucial for retail staffing agencies to maintain a watchful eye over their outstanding Accounts Receivables. Utilizing an effective third-party collection partner can help prevent distressed accounts from becoming write-offs. Our skilled team offers fast remittances, electronic payments, and unparalleled results. Expect our collector to place daily phone calls for the first 14 to 21 days in an attempt to contact the debtor. In addition, establishing clear payment terms and implementing effective collections processes can further mitigate future risks.

| Key Actions for Mitigating Future Risks |

|---|

| Maintain a watchful eye over Accounts Receivables |

| Utilize an effective third-party collection partner |

| Establish clear payment terms |

| Implement effective collections processes |

The complexities of post-judgment enforcement are paramount to successfully collecting obligations.

In conclusion, when it comes to debt collection solutions, simplicity is key. At No Recovery No Fee Debt Collections, we understand the importance of making debt collections simple and hassle-free. Our team is dedicated to providing effective and efficient debt collection services that prioritize your needs. With our no recovery, no fee policy, you can trust that we are committed to delivering results. Contact us today to learn more about how we can help you with your debt collection needs.

Frequently Asked Questions

What are the common causes of unpaid invoices?

Common causes of unpaid invoices include late payment by clients, disputes over services or products, and financial difficulties faced by clients.

How can retail staffing agencies establish clear payment terms?

Retail staffing agencies can establish clear payment terms by outlining payment terms in contracts, setting clear due dates for invoices, and communicating payment expectations with clients.

What are effective collections processes for managing unpaid invoices?

Effective collections processes for managing unpaid invoices include sending regular reminders to clients, escalating collection efforts when necessary, and offering flexible payment arrangements.

What is invoice factoring and how can it help with unpaid invoices?

Invoice factoring is a financial service where a company sells its accounts receivable to a third-party factor at a discount. This can help with unpaid invoices by providing immediate cash flow without waiting for client payments.

How can retail staffing agencies mitigate the risk of unpaid invoices in the future?

Retail staffing agencies can mitigate the risk of unpaid invoices in the future by conducting thorough client credit checks, implementing stricter payment terms, and diversifying their client base.

What legal recourse do retail staffing agencies have for unpaid invoices?

Retail staffing agencies can seek legal recourse for unpaid invoices through small claims court, hiring a collections agency, or pursuing legal action for breach of contract.